The market is hovering around the even line around 1:30 pm on Wednesday. Nasdaq is up about 6, NYSE is down about 1. Both the Nasdaq and NYSE trades in a narrow range today. The advancers to decliners are 18 to 13 on Nasdaq, and 17 to 11 on NYSE. The up to down volumes are 7 to 3 on Nasdaq and 1 to 1 on NYSE. The advances are clearly come from Nasdaq market. That is why the four-letter symbols are better than three-letter symbols.

Stocks worth mentioning are (more stock ideas from my private alert list):

(OSUR) was on my watch list about 1 week ago and yesterday. It is in the HIV test kit business. It wants to be an over-the-counter kit without prescription. The volume is picked up tremendous yesterday and today. It is making higher highs for past two days. It should be on your watch list as well. The good news today is its HIV test kit product to be launched in Mexico.

(RVSN), another winner for the day. It was on my stock alert list in the afternoon for my subscribers as well as on my blog. Subscribers will get the list faster and more stocks to be watched. It is in the design, development, and supply of products and technology that enable voice, video, and data communications over communication networks.

(LOJN), my long time favorite, it is making yet another high today. It is making higher highs for the past few days. I got in around $22 couple weeks ago when I mentioned as buy on my blog. It trades at aabout $28 now. It is in the wireless tracking and recovery products for mobile assets, such as PCs, cars, etc. The name LoJack is very popular among car dealers.

(GYMB), a retailer which sells apparel and accessories for women and children, as well as play programs for children, trades at a yearly high today. Its volume is 3 times normal. It announced good sale number for the current quarter this morning. Another good sign for the stock.

Daily Stock blog on US Stocks to be watched with up and down momentum. This blog is dedicated to take advantage of the wild up and down swing, and it presents opportunities to find stock market leaders for my readers. Stock Alerts, Stock Movers, Hot Stocks, Breakout Stocks, High Potential Stocks, Stocks to Watch.

Wednesday, November 30, 2005

Tuesday, November 29, 2005

Special Stock Alert

(RVSN), a massive breakout today. The volume is 500% more than the normal trading day. It is in the design, development, and supply of products and technology that enable voice, video, and data communications over packet networks.

Tuesday's Stocks To Watch

The market is hovering around the even line around 1:40 pm on Tuesday. Nasdaq is down about 5, NYSE is up about 1. Nasdaq came down from its high and went down today. Market is consolidating after the massive up moves in the past week. The good news is the volume is lower than normal trading days.

Stocks worth mentioning are (more stock ideas from my private alert list):

(CUTR), another favorite of mine, a leader in the medical edquipment field. It made another new high today. Its peers ((ELOS), (PMTI)) also marching upward as well. It shows that the whole group is doing well. That is confirmation of the upward movement is continuing.

(OSUR) and (FORM) the Cramer's effect stocks were all up today.

(OSUR) was on mu alert list about 1 week ago. It is in the HIV test kit business. It wants to be an over-the-counter kit without prescription.

(FORM) is in the semi capital equipment software industry. The semi group is doing well lately. I believe it may have more upsides to come.

(MTXX), is in the production, developement and sale of pharmaceutical products business. Its hot product is the ZiCam. This was also mentioned a few times on the blog as well.

(ESRX), is in the mail-to-order prescription business. The stock is on a tear recently. It was also mentioned as a stock to watch about a month ago.

Stocks worth mentioning are (more stock ideas from my private alert list):

(CUTR), another favorite of mine, a leader in the medical edquipment field. It made another new high today. Its peers ((ELOS), (PMTI)) also marching upward as well. It shows that the whole group is doing well. That is confirmation of the upward movement is continuing.

(OSUR) and (FORM) the Cramer's effect stocks were all up today.

(OSUR) was on mu alert list about 1 week ago. It is in the HIV test kit business. It wants to be an over-the-counter kit without prescription.

(FORM) is in the semi capital equipment software industry. The semi group is doing well lately. I believe it may have more upsides to come.

(MTXX), is in the production, developement and sale of pharmaceutical products business. Its hot product is the ZiCam. This was also mentioned a few times on the blog as well.

(ESRX), is in the mail-to-order prescription business. The stock is on a tear recently. It was also mentioned as a stock to watch about a month ago.

Monday, November 28, 2005

Monday's Stocks to Watch

The market edged down around noon on Monday. Nasdaq was down about -12 or 0.55%. Decliners outpaced advancers 2 to 1 on the Nasdaq and 19 to 12 on NYSE. The up to down volumes are about 5 to 3 on NYSE and 2 to 1 on Nasdaq. The good news is the volume is relatively as compared to the typical trading day.

Stocks worth considering within my up momentum criteria are:

(OXPS), mentioned from the previous posts. It is in the option trading business. It past thru the new high with very high volume. it was named Inc. Magazine's 2005 'Inc. 500' Lists Among Top Ten Fastest Growing Firms back in late October.

(NWRE), another strong stock in the computer thin-client business. I traded this one for

(LOJN) about 1 1/2 week ago. (LOJN) is a slight better performers at the time when I exchanged. Still this stock looks to go higher in the coming days.

(CUTR), mentioned numerous times, the top 5 IBD named stocks. It had a tremendious earning report last quarter. I believe more upside for this stock to come.

Stocks worth considering within my up momentum criteria are:

(OXPS), mentioned from the previous posts. It is in the option trading business. It past thru the new high with very high volume. it was named Inc. Magazine's 2005 'Inc. 500' Lists Among Top Ten Fastest Growing Firms back in late October.

(NWRE), another strong stock in the computer thin-client business. I traded this one for

(LOJN) about 1 1/2 week ago. (LOJN) is a slight better performers at the time when I exchanged. Still this stock looks to go higher in the coming days.

(CUTR), mentioned numerous times, the top 5 IBD named stocks. It had a tremendious earning report last quarter. I believe more upside for this stock to come.

Friday, November 25, 2005

Friday's Updates

Nothing to report today because I did not trade at all today because of Black Friday shopping with family. I will have the weekend post for the week ahead.

Wednesday, November 23, 2005

Wednesday's Stocks To Watch

The market is still continuing its uptrend journey today. It is up about +11 pts on Nasdaq, +7 on NYSE. The up momentum is still intact. The volume is pale compared to yesterday's volume, probably to due to the day before Thanksgiving holiday. The advancers to decliners are about 3 to 1 on both exchanges.

Stocks to Watched Today (more from my alert service):

(LOJN), another of my previous and holding favorites, see previous blogs. Another new high for this auto-thief prevention products company. Earning has been up for the past few quarters. New products are introduced to the market place, such as anti-thief computer locks, etc. Higher volumes on the up days, and lower on the down days. Another great up momentum sign.

(CWTR), volume has picked up a lot today, about 700% more than normal. It is a retailer of women's apparel, accessories, jewelry, and gift items. The advance move up today is contributed to its earning announced last night and the Cramer effect. Another reason is probably the X'mas holiday shopping season is near, many analyst expected a good X'mas for many retailers.

(NDAQ), this stock has been marching to new highs for the past few months without any correction. The stock is very extended, but the up momentum is unstoppable.

(AKAM), another new year high for this delivery of content and business processes over the Internet company. It had massive volume yesterday after the analyst upgrade. Wait for the entry point for this one. You will be rewarded if you get into this one. If it breaks $20 at a closing price, it is worth while to take a small position.

Happy Thanksgivings to all my readers. Wish you have a very nice gain in the holiday seasons to come.

Stocks to Watched Today (more from my alert service):

(LOJN), another of my previous and holding favorites, see previous blogs. Another new high for this auto-thief prevention products company. Earning has been up for the past few quarters. New products are introduced to the market place, such as anti-thief computer locks, etc. Higher volumes on the up days, and lower on the down days. Another great up momentum sign.

(CWTR), volume has picked up a lot today, about 700% more than normal. It is a retailer of women's apparel, accessories, jewelry, and gift items. The advance move up today is contributed to its earning announced last night and the Cramer effect. Another reason is probably the X'mas holiday shopping season is near, many analyst expected a good X'mas for many retailers.

(NDAQ), this stock has been marching to new highs for the past few months without any correction. The stock is very extended, but the up momentum is unstoppable.

(AKAM), another new year high for this delivery of content and business processes over the Internet company. It had massive volume yesterday after the analyst upgrade. Wait for the entry point for this one. You will be rewarded if you get into this one. If it breaks $20 at a closing price, it is worth while to take a small position.

Happy Thanksgivings to all my readers. Wish you have a very nice gain in the holiday seasons to come.

Tuesday, November 22, 2005

Tuesday's Stocks To Watch

The market is hovering around the even line around 1:00pm on Tuesday. The up and down volumes are as followed 17 to 13 on the NYSE, and 15 to 14 on the Nasdaq. They both about even. The advancers are out paced the decliners by about 6 to4 on the Nasdaq, and about even on the NYSE. So far the breath of market is still favorable for the bull.

Stocks worth mentioning are:

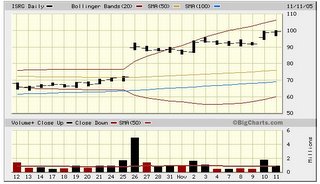

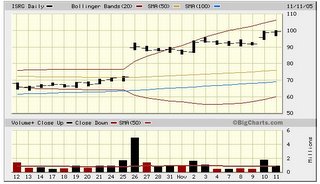

(ISRG), touched another new high mark at $117 this morning for this robotic medical equipment maker. If you have followed my blog from the beginning, then you may have picked it up in the high 80's or considered at that time. It is still looking very strong on a daily basis. The up momentum is building with higher volumes on the up days.

(CUTR), another favorite of mine, also mentioned several times on my blog as well, hitted another new high today. Another leader in the medical edquipment field.

(CMED), also another strong stock in the medical edquipment field, mentioned on my blog as well in the past, roared another new high past $40 intraday.

(MTXX), a marketer and developer of over-counter pharmaceutical products. The popular ZiCam cold remedy is one of the reason why this company is so hot. Its product is hot demand by consumers because of the flu season. It was mentioned about 2 weeks ago as well.

Other stocks that met my up momentum criteria are:

OSUR, CTRN, others (from my alert services)

As we can see, the medical edquipment field, is a one of the leading group in the market recently. There are many more leaders in many industries, (MRVL) is one from the semi industry. In today's bull market (I believe we should have a very merry X'mas for the stock market this year), stock leaderships are the way to make money for you. If you keep reading my blog on a daily basis, you will get some idea of the stocks that you can invested in.

Stocks worth mentioning are:

(ISRG), touched another new high mark at $117 this morning for this robotic medical equipment maker. If you have followed my blog from the beginning, then you may have picked it up in the high 80's or considered at that time. It is still looking very strong on a daily basis. The up momentum is building with higher volumes on the up days.

(CUTR), another favorite of mine, also mentioned several times on my blog as well, hitted another new high today. Another leader in the medical edquipment field.

(CMED), also another strong stock in the medical edquipment field, mentioned on my blog as well in the past, roared another new high past $40 intraday.

(MTXX), a marketer and developer of over-counter pharmaceutical products. The popular ZiCam cold remedy is one of the reason why this company is so hot. Its product is hot demand by consumers because of the flu season. It was mentioned about 2 weeks ago as well.

Other stocks that met my up momentum criteria are:

OSUR, CTRN, others (from my alert services)

As we can see, the medical edquipment field, is a one of the leading group in the market recently. There are many more leaders in many industries, (MRVL) is one from the semi industry. In today's bull market (I believe we should have a very merry X'mas for the stock market this year), stock leaderships are the way to make money for you. If you keep reading my blog on a daily basis, you will get some idea of the stocks that you can invested in.

Monday, November 21, 2005

Monday's Stocks To Watch

The market is about at even mark around noon on Monday. The volume for the market has slowed a bit today as compared last Friday. Up/down and advancers/decliners ratios are about even for Nasdaq and NYSE. It is still building the uptrend momentum for the days to come. I expect more up days to come until end of the end year.

The stock market leaders I have mentioned previously are in the consolidation mode right now. (ISRG) is tempting to break the new high it recorded last week. (CUTR) is acting well today. Its volume is on pace to be 200% higher than the typical trading volumes. (MRVL) is down slightly after the giantic move last Friday.

I saw a few stocks creeked popped up that met my searching criteria today. They are (GROW), (STMP), (CMED), and a few others (from my alert service). They are exhibiting strong up momentum moves. (GROW) is engaging in the mutual fund business, it announced great earnings last week. The volume has picked lately. (STMP) is attacking its new high with good volume. (CMED), another one of favorite, mentioned on the weekend post, it continues its roaring move with almost 1000% more volumes than normal. I am a bit hesitant to add more to my position at this time.

The stock market leaders I have mentioned previously are in the consolidation mode right now. (ISRG) is tempting to break the new high it recorded last week. (CUTR) is acting well today. Its volume is on pace to be 200% higher than the typical trading volumes. (MRVL) is down slightly after the giantic move last Friday.

I saw a few stocks creeked popped up that met my searching criteria today. They are (GROW), (STMP), (CMED), and a few others (from my alert service). They are exhibiting strong up momentum moves. (GROW) is engaging in the mutual fund business, it announced great earnings last week. The volume has picked lately. (STMP) is attacking its new high with good volume. (CMED), another one of favorite, mentioned on the weekend post, it continues its roaring move with almost 1000% more volumes than normal. I am a bit hesitant to add more to my position at this time.

Sunday, November 20, 2005

Stock Market Weekend Review - What's Ahead for Next Week

Another great week for the market. Nasdaq broke a series of new year high last week. It continues the strong up momentum build up from last week. It looks to be a merry X'mas for many investors.

Unlike the old days, today's market is stock pickers' market. In the late 80's and the 90's, if you pick a stock and stay with it, you will make money. But today's market, if you pick the wrong one, you will get harmered with the stock. If you pick the stocks that are not performing, you will just watch other people making money instead of you. Therefore, it is very important to pick stock market in today's market.

More and more market emerged last week as the market marched up last week, it is another good sign for the rally to continue. Beside the market leaders I have mentioned last week (ISRG), (CUTR), (LOJN), I will bring up more stocks for the coming week.

This week the semiconductor stocks broke thru the resistance level for the first time in a while. This should up lift the rest of the non-performing stocks in the group. (MRVL) is clearly a semi group leader. It gapped up last Friday with very powerful up volume because of the good earning and upbeat guidance. Other names in the groups are: (MSCC), (KLIC) (will break new high soon), AMD, and (DIOD).

Aside from the semi area, another one is worth mentioned is (CMED), it broke a series of new highs for the past two weeks. I believe the 10-day moving average is the entry point for this stock. It is Chinese medical technology stock. Its main focus is in the area of ultrasound therapy system for cancer treatments. It is a very hot industry in a high demand country of China.

(NDAQ), the Nasdaq exchange stock. Like many of the exchangers, (CME) and (CBOT). It is making higher high on a weekly basis. It has very strong up momentum.

Unlike the old days, today's market is stock pickers' market. In the late 80's and the 90's, if you pick a stock and stay with it, you will make money. But today's market, if you pick the wrong one, you will get harmered with the stock. If you pick the stocks that are not performing, you will just watch other people making money instead of you. Therefore, it is very important to pick stock market in today's market.

More and more market emerged last week as the market marched up last week, it is another good sign for the rally to continue. Beside the market leaders I have mentioned last week (ISRG), (CUTR), (LOJN), I will bring up more stocks for the coming week.

This week the semiconductor stocks broke thru the resistance level for the first time in a while. This should up lift the rest of the non-performing stocks in the group. (MRVL) is clearly a semi group leader. It gapped up last Friday with very powerful up volume because of the good earning and upbeat guidance. Other names in the groups are: (MSCC), (KLIC) (will break new high soon), AMD, and (DIOD).

Aside from the semi area, another one is worth mentioned is (CMED), it broke a series of new highs for the past two weeks. I believe the 10-day moving average is the entry point for this stock. It is Chinese medical technology stock. Its main focus is in the area of ultrasound therapy system for cancer treatments. It is a very hot industry in a high demand country of China.

(NDAQ), the Nasdaq exchange stock. Like many of the exchangers, (CME) and (CBOT). It is making higher high on a weekly basis. It has very strong up momentum.

Friday, November 18, 2005

Friday's Stocks To Watch

The market is slight up around 1:45pm on Friday. The trading volume is on track to be lower than yesterday's massive advance yesterday. Many market leaders are still on pace with the market's uptrend.

(MRVL) is the star of the day. As mentioned on yesterday's post, it is indeed high percentage mover on the market. It is up about 13% as I am typing this post. It is a huge percentage move when you consider the market cap of the stock and it stock price. The reason for the move is very obvious, it beat the street estimates and guides up the following quarter. Like the other market leader, (ISRG), it is the stock to own. (MRVL) makes semi chips which are used in many electronics gadgets. It is the Intel of its domain.

Other stocks in the same industry that are exhibit the strong up momentum like (MRVL) are (MSCC) - another one mentioned yesterday; (DIOD), chart looks great on this one.

Since I have limited time to spend on my blog today, I am delaying of market leadership post until the weekend post. Market leaders will dictate how much you can make in a bull market like the recent trading days. I am expecting a Merry X'mas for the stock investors. But this time is the stock pickers market, forget the (DELL), (MSFT), and (CSCO) of the world, pick something like (MRVL). You will be rewarded very handily in the weeks to come.

(MRVL) is the star of the day. As mentioned on yesterday's post, it is indeed high percentage mover on the market. It is up about 13% as I am typing this post. It is a huge percentage move when you consider the market cap of the stock and it stock price. The reason for the move is very obvious, it beat the street estimates and guides up the following quarter. Like the other market leader, (ISRG), it is the stock to own. (MRVL) makes semi chips which are used in many electronics gadgets. It is the Intel of its domain.

Other stocks in the same industry that are exhibit the strong up momentum like (MRVL) are (MSCC) - another one mentioned yesterday; (DIOD), chart looks great on this one.

Since I have limited time to spend on my blog today, I am delaying of market leadership post until the weekend post. Market leaders will dictate how much you can make in a bull market like the recent trading days. I am expecting a Merry X'mas for the stock investors. But this time is the stock pickers market, forget the (DELL), (MSFT), and (CSCO) of the world, pick something like (MRVL). You will be rewarded very handily in the weeks to come.

Thursday, November 17, 2005

Thursday's Stocks to Watch

The market (Nasdaq) is up about 13 points at mid-day Thursday. Up volumes outpace down volumes, at least 2 to 1 on both exchanges. Advance issues also outpace decline issues. All these statistics are bold well for the market to have a holiday rally in the coming weeks. The strong up momentum is still intact for the market. Use your cash to buy stocks, not just normal stocks, but stocks with market leaderships.

Speaking of leaderships, the following stocks are worth mentioning:

(CUTR), profiled last weekend, it is up again and it penetrates the old highs created in the recent days. The stock broke the cup and handle formation, it is a leader in its fields. Even its competitors are doing well, (ELOS), it is very close to its old highs as well. The whole medical laser group over all is doing very well.

(LOJN), another one I mentioned several days ago. If you go thru all the archives from my blog, you should be able to find it. It is in the anti auto-thief business. Its products are in high demand. It has the biggest market share in its business. More dealerships are installing their systems to their customers than ever before. Besides the auto business. It tries tackle the computer thief business as well.

(ISRG) is no doubt, another gang buster. it was mentioned multiple times.

After the market closes today, look for earnings from (MRVL), (MSCC), and (HIBB). These are some of the biggest potential movers. (GYMB) was a good buy before close yesterday. I sold them this morning because it guided down its earning for next quarter.

Tomorrow's post, I will bring up more leaders to you all to see. In today's strong up mometum market, if you can not buy market leaders, then you are losing opportunity to make money. Until next time.

Speaking of leaderships, the following stocks are worth mentioning:

(CUTR), profiled last weekend, it is up again and it penetrates the old highs created in the recent days. The stock broke the cup and handle formation, it is a leader in its fields. Even its competitors are doing well, (ELOS), it is very close to its old highs as well. The whole medical laser group over all is doing very well.

(LOJN), another one I mentioned several days ago. If you go thru all the archives from my blog, you should be able to find it. It is in the anti auto-thief business. Its products are in high demand. It has the biggest market share in its business. More dealerships are installing their systems to their customers than ever before. Besides the auto business. It tries tackle the computer thief business as well.

(ISRG) is no doubt, another gang buster. it was mentioned multiple times.

After the market closes today, look for earnings from (MRVL), (MSCC), and (HIBB). These are some of the biggest potential movers. (GYMB) was a good buy before close yesterday. I sold them this morning because it guided down its earning for next quarter.

Tomorrow's post, I will bring up more leaders to you all to see. In today's strong up mometum market, if you can not buy market leaders, then you are losing opportunity to make money. Until next time.

Wednesday, November 16, 2005

Today After-Market Preview Stock

(GYMB) is expected to announce earning tonight. Base on past history of the stock performance and the strong up momentum of the stock, I believe it will beat the estimate. It would be an interesting play before the market closes.

(ZUMZ) is also expected to announce earning tonight. If you think it will have the same performance as (DKS), then you can place your bet on this one.

(ZUMZ) is also expected to announce earning tonight. If you think it will have the same performance as (DKS), then you can place your bet on this one.

Wednesday's Stocks Updates

The market is about even around 2:10pm today, and it trades in a narrow range. The up and down volume is about even on NYSE and Nasdaq. But there are more decliners than advancers on the Nasdaq, about 2 to 1 ratio. The trading volume is slightly lower than yesterday's pace.

Even though we had some correction yesterday, I believe the market is still in an uptrend. I expect the market to break this year's new highs by the end of the year. We should have an up year this time around.

Speaking of the up market, it is important to pick the winners from the sea of stocks. (SRLS) is one the examples of a stock market leadership. It was profiled twice on my blog, one as a stock alert, and another time mentioned as a test buy yesterday.

(ISRG) is another one, one of favorites, is down $3 today, after many days of more than 2% advances. This is expected, I expect $100 is the support level for this one. We may or maybe see it in the coming days.

Look for earning reports from a few well known companies tomorrow: (MRVL), one of the top semi performers; (RAVN), and (JWN). From the recent trading actions of (MRVL), I expect it to beat the estimates. This stock can be violatile, it can be considered as an option play.

Today's stock to avoid:

(BCSI), gapped down on earning with heavy volume. It is a sell today. It can also be a short candidate depending on the price entry. Even at this price level, it can be decent. I would place a stop lost at $43, which is today's high, just in case to reduce risk. I normally do not play short myself, but this one looks OK to me. I expect more downsides to come.

Today's stock to consider as buy:

(AAPL) - another new higher today with X'mas is coming. The iPod with video should be good demand

(TESOF) - strong up momentum with 500% more volume than normal

(GILD) - 300% more up volume than normal

Even though we had some correction yesterday, I believe the market is still in an uptrend. I expect the market to break this year's new highs by the end of the year. We should have an up year this time around.

Speaking of the up market, it is important to pick the winners from the sea of stocks. (SRLS) is one the examples of a stock market leadership. It was profiled twice on my blog, one as a stock alert, and another time mentioned as a test buy yesterday.

(ISRG) is another one, one of favorites, is down $3 today, after many days of more than 2% advances. This is expected, I expect $100 is the support level for this one. We may or maybe see it in the coming days.

Look for earning reports from a few well known companies tomorrow: (MRVL), one of the top semi performers; (RAVN), and (JWN). From the recent trading actions of (MRVL), I expect it to beat the estimates. This stock can be violatile, it can be considered as an option play.

Today's stock to avoid:

(BCSI), gapped down on earning with heavy volume. It is a sell today. It can also be a short candidate depending on the price entry. Even at this price level, it can be decent. I would place a stop lost at $43, which is today's high, just in case to reduce risk. I normally do not play short myself, but this one looks OK to me. I expect more downsides to come.

Today's stock to consider as buy:

(AAPL) - another new higher today with X'mas is coming. The iPod with video should be good demand

(TESOF) - strong up momentum with 500% more volume than normal

(GILD) - 300% more up volume than normal

Tuesday, November 15, 2005

Tuesday's Stocks To Watch

At mid-day, the market is edge down slightly. Home Depot (HD) failed to inspire the market after reported earning and ups its guidance on the coming quarter this morning. Home Depot is no longer a market leader like what it enjoyed decades ago. Like the Microsft, Dell, and Intel of the world, it is well over owned.

In this today's strong uptrend momentum market, fail to find market leaders will let you lose money making opportunities. If you look at the past weeks, (ISRG) is emerging as one of the top market leaders. Like (GOOG) is dominating the internet search world, (ISRG) is dominating the medical surgical robot world. I believe more upside for this stock to come.

Today's Stocks to Watch:

(ISRG), many of my blog readers have seen my blog and pushing this one as a winner.

(SRLS), another on my stock alert last week as well, see post. It is company engages in manufacture and provision of biological products and services for the diagnostic, therapeutic, drug discovery, and research organizations worldwide. Earning is expected to come out soon. Although it is a bit risky to play right now, I believe it maybe worth the risk. The stock is up in the down market, it has very strong up momentum for the past weeks.

Other stocks are worth looking at today are:

(ELOS), (HANS), (AMZN), (CYH), (BOBE)

Stocks For Potential Sell are:

(CPSI), (WBSN), (TGT), (ESE)

In this today's strong uptrend momentum market, fail to find market leaders will let you lose money making opportunities. If you look at the past weeks, (ISRG) is emerging as one of the top market leaders. Like (GOOG) is dominating the internet search world, (ISRG) is dominating the medical surgical robot world. I believe more upside for this stock to come.

Today's Stocks to Watch:

(ISRG), many of my blog readers have seen my blog and pushing this one as a winner.

(SRLS), another on my stock alert last week as well, see post. It is company engages in manufacture and provision of biological products and services for the diagnostic, therapeutic, drug discovery, and research organizations worldwide. Earning is expected to come out soon. Although it is a bit risky to play right now, I believe it maybe worth the risk. The stock is up in the down market, it has very strong up momentum for the past weeks.

Other stocks are worth looking at today are:

(ELOS), (HANS), (AMZN), (CYH), (BOBE)

Stocks For Potential Sell are:

(CPSI), (WBSN), (TGT), (ESE)

Monday, November 14, 2005

Monday Stock Market Update

The market traded slightly down around 1:30pm Monday ahead of the PPI and CPI numbers which will be reported on Tuesday and Wednesday respectively. The market may already factors in the increases of the prices due to oil prices surges recently. The uptrend for the market is still intact. Market leaders still keep advancing and hold their strong up momentum. Unless the trend of the market or stocks have changes, there is no need to sell the market leaders.

Speaking of market leaders, (ISRG) is definitely belongs to this category. This stock has been profiled two weeks ago by my blog before it was upgraded by the wall street broker. Let's examine this stock closely and present my bullish view of this stock.

(ISRG), Intuitive Surgical, Inc., it is in the medical equipment field. Its medical robots, da Vinci Surgical System, are in high demand. It is one of the desruptive technology out there which are monopolizing the market place. According to Yahoo's Finance Profile:

Speaking of market leaders, (ISRG) is definitely belongs to this category. This stock has been profiled two weeks ago by my blog before it was upgraded by the wall street broker. Let's examine this stock closely and present my bullish view of this stock.

(ISRG), Intuitive Surgical, Inc., it is in the medical equipment field. Its medical robots, da Vinci Surgical System, are in high demand. It is one of the desruptive technology out there which are monopolizing the market place. According to Yahoo's Finance Profile:

Intuitive Surgical engages in the design, manufacture, and marketing of the da Vinci Surgical System for use in urologic, cardiothoracic, and general surgeries. The da Vinci Surgical System consists of a surgeon’s console, a patient-side cart, and proprietary instruments. It translates the surgeon’s natural hand movements on instrument controls at a console into corresponding micro-movements of instruments positioned inside the patient through small puncture incisions or ports. The system provides the surgeon with motion, fine tissue control, and 3-D vision characteristic of open surgery, while simultaneously allowing the surgeon to work through small ports. The company also manufactures various EndoWrist instruments, including forceps, scissors, electrocautery, scalpels, and other surgical tools, which incorporate a wrist joint with tips customized for various surgical procedures. Its other products include Aesop Endoscope Positioner, a voice-activated robotic arm that automates the critical task of endoscope positioning; and Hermes Control Center, a centralized system designed to voice control a series of networked smart medical devices. The company sells its products through direct sales force in the United States and Europe, as well as through distributors in Australia, Canada, India, Italy, Romania, Saudi Arabia, Singapore, Taiwan, and Turkey. Intuitive surgical was co-founded by John G. Freund, Frederic Moll, and Robert Younge in 1995. The company is headquartered in Sunnyvale, California.I believe this young company is the fomer Medtronic in the making. IBD has the over 90 for all of its scores. The stock is making higher high on a daily basis. My bold prediction is: it maybe a $125 stock by Thanksgiving time. Or $150 by X'mas time.

Sunday, November 13, 2005

Stock Market Weekend Review - What's Ahead for Next Week

Another great week for the market. Nasdaq broke the 2200 barrier the first time since early August. I expect more upside for the market for the rest of the year. The upside momentum is definitely building every day.

More leaders are merging as the market roaring to higher high.

One of the leaders which made it to the top spot on the IBD chart is (CUTR). It gapped up on early November because of great earning and upside guidance. Although it is a bit extended, but I believe it has more upside if the market continues its up momentum trend, see chart.

One of the leaders which made it to the top spot on the IBD chart is (CUTR). It gapped up on early November because of great earning and upside guidance. Although it is a bit extended, but I believe it has more upside if the market continues its up momentum trend, see chart.

(ISRG) like I have mentioned previously, more than a week ago. Even though it did not make it to the top IBD list, but no doubt, it is clearly a stock market leader on its own. It gapped up $18 on the date of earning on October 26. More volumes are up days, lower volumes on the down day, another bullish sign. I expect more upside to come.

I will update my blog at least once during trading hours or after the market close. More details will be provided than ever before.

More leaders are merging as the market roaring to higher high.

One of the leaders which made it to the top spot on the IBD chart is (CUTR). It gapped up on early November because of great earning and upside guidance. Although it is a bit extended, but I believe it has more upside if the market continues its up momentum trend, see chart.

One of the leaders which made it to the top spot on the IBD chart is (CUTR). It gapped up on early November because of great earning and upside guidance. Although it is a bit extended, but I believe it has more upside if the market continues its up momentum trend, see chart.

(ISRG) like I have mentioned previously, more than a week ago. Even though it did not make it to the top IBD list, but no doubt, it is clearly a stock market leader on its own. It gapped up $18 on the date of earning on October 26. More volumes are up days, lower volumes on the down day, another bullish sign. I expect more upside to come.

I will update my blog at least once during trading hours or after the market close. More details will be provided than ever before.

Friday, November 11, 2005

Friday's After Market Report

The market closed near the high of the day with very range. The volume is bit low as compared to normal trading days because the US holiday. It is still in a confirm rally mode.

Many small and mid cap stocks marched higher. Another sign of higher market trend. Many notable winners are: NETL, JOLN, MTXX, CMED, NILE, PWEI, TOMO. Look for them to continue their up momentum in the days to come.

After Market Movers:

Positive Momentum Movers:

RSTI

Negative Momentum Movers (none):

Many small and mid cap stocks marched higher. Another sign of higher market trend. Many notable winners are: NETL, JOLN, MTXX, CMED, NILE, PWEI, TOMO. Look for them to continue their up momentum in the days to come.

After Market Movers:

Positive Momentum Movers:

RSTI

Negative Momentum Movers (none):

Friday's Mid-Day Report

The market is up around mid day. It is continuing from yesterday's strong momentum with big volume. More upside is coming for the rest of the year and continues to early next year.

The volume is bit light today because of the US veteran holiday, people are taking a break from work, and perhaps they are doing some holiday shoppings now. I believe the retailers will have a good merry X'mas this year because the oil price has came down a bit lately.

ISRG is digesting its gain from yesterday's $5 move. I believe this one still has more upsides to come. $120 by X'mas time, it can be even higher if they announce split. Nothing is stopping it now.

Stocks to watch around noon time:

MTXX - about 600% more volume than usual to the upside

CMED - this one is on a tear lately, look for consolidation soon, put it on your list

I got some feedbacks from my readers, they want updates during trading hours if possible. So to satisfy my loyal readers, starting next week, I will post at least one blog a day, this one can be during the trading hours or after close instead of just after close, depending on the timing of my work.

Thank you for all your feedbacks. More comments are welcome.

The bull is coming!!!!! Do not block its way!

The volume is bit light today because of the US veteran holiday, people are taking a break from work, and perhaps they are doing some holiday shoppings now. I believe the retailers will have a good merry X'mas this year because the oil price has came down a bit lately.

ISRG is digesting its gain from yesterday's $5 move. I believe this one still has more upsides to come. $120 by X'mas time, it can be even higher if they announce split. Nothing is stopping it now.

Stocks to watch around noon time:

MTXX - about 600% more volume than usual to the upside

CMED - this one is on a tear lately, look for consolidation soon, put it on your list

I got some feedbacks from my readers, they want updates during trading hours if possible. So to satisfy my loyal readers, starting next week, I will post at least one blog a day, this one can be during the trading hours or after close instead of just after close, depending on the timing of my work.

Thank you for all your feedbacks. More comments are welcome.

The bull is coming!!!!! Do not block its way!

Friday's Pre-Market

The market is expected to open higher today with continuation from yesterday's strong up momentum. Today is the Veteran's holiday for the US market, but it is still open today. All signs are positive right now, CSCO did not make a dent, record high trade deficit did not prove to be a problem right now, oil price is below $60 per barrel and trending downward. All sign for the market to break the old high for the year.

Many leaders have emerged lately: ISRG, mentioned several times on this blog, more upsides still expected; SRLS breaking new high soon with a lot of momentum; GOOG, no doubt the biggest name on the net; HANS, keeps on breaking new highs. There are many more to be listed.

Starting next week, I will do one blog each day after the market close. More indepth analysis than right now, more stock ideas, and reasons behind each move.

Only the subscribers will get the one or more updates during trading hours, and the stock alerts.

Today's Market Movers:

Positive Momemtum Stocks:

PLAY (withdrew secondary), PWEI (upside guidance), TOMO (continuation from yesterday)

Negative Momemtum Stocks:

BLUDE (delay filing), VNUS, CTRP, energy related stocks

Many leaders have emerged lately: ISRG, mentioned several times on this blog, more upsides still expected; SRLS breaking new high soon with a lot of momentum; GOOG, no doubt the biggest name on the net; HANS, keeps on breaking new highs. There are many more to be listed.

Starting next week, I will do one blog each day after the market close. More indepth analysis than right now, more stock ideas, and reasons behind each move.

Only the subscribers will get the one or more updates during trading hours, and the stock alerts.

Today's Market Movers:

Positive Momemtum Stocks:

PLAY (withdrew secondary), PWEI (upside guidance), TOMO (continuation from yesterday)

Negative Momemtum Stocks:

BLUDE (delay filing), VNUS, CTRP, energy related stocks

Thursday, November 10, 2005

Thursday's After-Market

The market closed near the high of the day. The volume picked from yesterday. Another positive sign, another accumulation day for the chartist. CSCO cannot influence the market at all. The market opened low, and it ended higher. The bull is roaring now. It is time to load up your market leader stocks now.

I invested fully now, and partially on margin as well. Unless something causes the market to change direction, I am 100% in the market now. BUY! BUY! BUY!

Like I mentioned before, ISRG is a leader in its own field. It is Medtronic in the making. It had a great day. Even though it did not hit $100 today, I believe it will soon, perhaps we may see it tomorrow. In this kind of bull market, it is worth to pick market leader like ISRG, GOOG, as well as many others. MRGE is another worth considering. If you visit my blog on a daily basis. You will find some along the way.

After Market Movers:

Positive Momentum Movers:

PLAY, FMD (contract extension),

Negative Momentum Movers:

DWRI, NCTY, INCX, VNUS (none of them have any market impact)

I invested fully now, and partially on margin as well. Unless something causes the market to change direction, I am 100% in the market now. BUY! BUY! BUY!

Like I mentioned before, ISRG is a leader in its own field. It is Medtronic in the making. It had a great day. Even though it did not hit $100 today, I believe it will soon, perhaps we may see it tomorrow. In this kind of bull market, it is worth to pick market leader like ISRG, GOOG, as well as many others. MRGE is another worth considering. If you visit my blog on a daily basis. You will find some along the way.

After Market Movers:

Positive Momentum Movers:

PLAY, FMD (contract extension),

Negative Momentum Movers:

DWRI, NCTY, INCX, VNUS (none of them have any market impact)

Stock Special Alert

SRLS is the one to watch today. Its earning is coming out soon. It is in the right industry, the medical field arena. The same general field as ISRG. We all know how well this one has performed over the past weeks. I believe this one has the potential to go much higher, to the $25 range. The chart also shows its strong up momentum in the recent days. It is the building the handle, and it should break out of this handle when it touches $21.

Thursday's Mid-Day Report

The market is down for all exchanges around noon today. The catalysts for today's down day are contributed by Cisco's earning and US Trade gap deficit is at record high.

ISRG is the star of the day. I believe it will hit $100 very soon. It is one of the leader on the market today. It has great momentum, technicaly and fundamentally. This one has been mentioned several times before today's run-up. To me, it is long term hold until its momentum is broken. It is the google of the medical field.

On the contrary, CSCO was the leader of yester-year. It no longer commands the premium it deserved years ago. Like Dell and Microsoft of the world, they will be forgotten as the market leader under the stock market rules.

Today's Movers:

Positive Momentum Stocks (to be considered):

ISRG, HANS, IRBT (new issue, to be proven)

Negative Momentum Stocks:

VPHM, WFMI, TRGL, oil related sections

ISRG is the star of the day. I believe it will hit $100 very soon. It is one of the leader on the market today. It has great momentum, technicaly and fundamentally. This one has been mentioned several times before today's run-up. To me, it is long term hold until its momentum is broken. It is the google of the medical field.

On the contrary, CSCO was the leader of yester-year. It no longer commands the premium it deserved years ago. Like Dell and Microsoft of the world, they will be forgotten as the market leader under the stock market rules.

Today's Movers:

Positive Momentum Stocks (to be considered):

ISRG, HANS, IRBT (new issue, to be proven)

Negative Momentum Stocks:

VPHM, WFMI, TRGL, oil related sections

Thursday's Pre-Market Updates

The market is poised to open lower today after earning announcement from Cisco last night. Initially it was up after hour yesterday, probably because of the conference call contributes the drop this morning. Like Dell a few days ago, it is a none event for the market. It is no longer a market leader like yester-year. It is over owned by many. I believe the market is still on the uptrend.

ISRG is one of the big movers today. Like I have mentioned previously, I believe $100 mark is no long to reach. I am hoping for before the month is over. Unlike CSCO, it is a market leader in its infancy. I am still bullish on this one.

Today's Market Movers:

Positive Momemtum Stocks:

RSTI, IRBT, ISRG, NVDA, PTIE

Negative Momemtum Stocks:

CSCO, SNDA, MORN, WFMI (Too much expectation built-in, get out now), URBN

ISRG is one of the big movers today. Like I have mentioned previously, I believe $100 mark is no long to reach. I am hoping for before the month is over. Unlike CSCO, it is a market leader in its infancy. I am still bullish on this one.

Today's Market Movers:

Positive Momemtum Stocks:

RSTI, IRBT, ISRG, NVDA, PTIE

Negative Momemtum Stocks:

CSCO, SNDA, MORN, WFMI (Too much expectation built-in, get out now), URBN

Wednesday, November 09, 2005

Wednesday's After Market

The market closed near the unchange mark for all exchanges. Another digesting mode for the market. The market was for a brief moment, then it faded away because of the explosion from Jordan. Terrorism is still a concern for all of us.

Even though the Jordan explosion caused the market to came down from its high, but it was still up for the day. The uptrend is still intact. To play the terrorism theme, ASEI is a good play. It ran up more $5 today because it blew the estimate, and it is in the right industry.

I ran an alert this morning on TIII, if you read the previous posts, you know why this ran up today. I believe this one still has a lot of upsides.

CSCO reported earning after close, it ran up about 0.45 after hour. This stock is over own by many institutions and investors. It is the yester-year stock. We may have a good day for the networks tomorrow at the open. It is too boring for me to own it. No momentum at all.

After Market Movers (Not too much action):

Positive Momentum Movers (none worth while mentioning):

Negative Momentum Movers:

SNDA

Even though the Jordan explosion caused the market to came down from its high, but it was still up for the day. The uptrend is still intact. To play the terrorism theme, ASEI is a good play. It ran up more $5 today because it blew the estimate, and it is in the right industry.

I ran an alert this morning on TIII, if you read the previous posts, you know why this ran up today. I believe this one still has a lot of upsides.

CSCO reported earning after close, it ran up about 0.45 after hour. This stock is over own by many institutions and investors. It is the yester-year stock. We may have a good day for the networks tomorrow at the open. It is too boring for me to own it. No momentum at all.

After Market Movers (Not too much action):

Positive Momentum Movers (none worth while mentioning):

Negative Momentum Movers:

SNDA

Wednesday's Mid-Day Update

The market is about unchange around mid-day today. It is still in the digesting mode. There are a few things are good for the market today: lower oil price and a string of strong up days in the past week. Oil price dropped below $59 a barrel after the US oil reserve inventory report today.

HANS is the star of the day. It blew the estimate by $0.23. There were many short sellers for this stock. A short squeeze occurred this morning because of it. In this kind of market, strong up days, I would advise not to short at all. Even bad stocks in good market can go up.

TIII is another one worth speculate with. I do not usually advicate low price stocks, but this one is an exception, it has its own merit. The volume on this one picked up dramatically as compared to its typical trading day. It reported earning today, see my alert this morning. I sent out the alert around 10AM this morning. I picked up some around $2.50 today. My subscribers should be able to got in around $2.50 this morning as well. Anyway I believe it may go to $5 very soon, perhaps by the end of the year. It is a doubler in a couple month.

Today's Movers:

Positive Momentum Stocks (to be considered):

HANS, ASEI, PIXR

Negative Momentum Stocks:

SNIC, INPC, ENER

HANS is the star of the day. It blew the estimate by $0.23. There were many short sellers for this stock. A short squeeze occurred this morning because of it. In this kind of market, strong up days, I would advise not to short at all. Even bad stocks in good market can go up.

TIII is another one worth speculate with. I do not usually advicate low price stocks, but this one is an exception, it has its own merit. The volume on this one picked up dramatically as compared to its typical trading day. It reported earning today, see my alert this morning. I sent out the alert around 10AM this morning. I picked up some around $2.50 today. My subscribers should be able to got in around $2.50 this morning as well. Anyway I believe it may go to $5 very soon, perhaps by the end of the year. It is a doubler in a couple month.

Today's Movers:

Positive Momentum Stocks (to be considered):

HANS, ASEI, PIXR

Negative Momentum Stocks:

SNIC, INPC, ENER

Today's Special Stock Alert

TII Network Technologies Inc. jumped up 75 cents, or 36% to $2.82 in morning trading Wednesday after it reported its quarterly profit more than double from year-ago levels. The Copiague, N.Y. the maker of telecommunications products company posted net income of $1.5 million, or 12 cents a share compared with $597,00, or 5 cents a share in the same quarter a year ago. Sales for the period ended Sept 30 jumped 58.7% to $11 million, with the help of expanded supply agreement with its largest customer and an additional week to ship its products compared with last year. It has several hot products for the telecom industries, such as VOIP, DSL. It made 52-week high today. It is worth a look.

This is an example of the private special stock alerting service for my subscribers. Please contact me if you want to subscribe to it.

This is an example of the private special stock alerting service for my subscribers. Please contact me if you want to subscribe to it.

Wednesday's Pre-Market

The market is poised to open mix today after a few straight days of strong up days. There is no major announcement from the US governemtn today.

Like the tale of two cities, we have a tale of two big winners and two big losers. Two notable winners are: HANS and ASEI. Both beat estimates handily. Both have many short sellers against their trends.

On the other hand, ENER and SNIC, both missed the estimates. ENER had a lot of hypes because of alternative energy play.

Today's Market Movers:

Positive Momemtum Stocks:

HANS, ASEI, PIXR

Negative Momemtum Stocks:

ENER, SNIC

Like the tale of two cities, we have a tale of two big winners and two big losers. Two notable winners are: HANS and ASEI. Both beat estimates handily. Both have many short sellers against their trends.

On the other hand, ENER and SNIC, both missed the estimates. ENER had a lot of hypes because of alternative energy play.

Today's Market Movers:

Positive Momemtum Stocks:

HANS, ASEI, PIXR

Negative Momemtum Stocks:

ENER, SNIC

Tuesday, November 08, 2005

Tuesday's After Market

The first down day for the market in more than a week. It only down a bit today. The market is still looking strong and the uptrend is still intact. Even though the housing had a bad day today, but it hardly made a budge on the market at all. I expect more good things to come.

After Market Movers (Not much action except PIXR, expect a new high at the open):

Positive Momentum Movers:

PIXR, JMDT

Negative Momentum Movers:

ENER (Missed earning estimates, big expectation built in, expect more down side to come), SNIC, INPC

After Market Movers (Not much action except PIXR, expect a new high at the open):

Positive Momentum Movers:

PIXR, JMDT

Negative Momentum Movers:

ENER (Missed earning estimates, big expectation built in, expect more down side to come), SNIC, INPC

Tuesday's Mid-Day

The market is slightly down around mid-day today. It is still in the digesting mode. The home builders are down today because Toll Brother (TOL) lowers its guidance for next year. Other building material companies are down as well because of TOL.

BOOM is not longer booming. It was down around $3 by mid-day. It was up more than $1 this morning pre-market. Then it decided to change its trend. This is very negative for the stock. It ran up too fast too soon. Wait until the dust settles, then we can come back and look at it again later.

AQNT is very similar to BOOM in trading pattern. Even thought it beat estimate by 3 cents. It was not good enough because of the big run from the beginning of the year from $7 to $21 right now. It has too much good expectation built into the stock.

All stocks are self correcting right now. This is a good thing because we do need some kind of self-correct mechanism for the market in order to march higher.

ISRG was down this morning, it went back up by mid-day. It still has very strong momentum to the upside. I still maintain my position as it will hit $100 by Thanksgiving. If it announces split, it will go up even further up.

Today's Movers:

Positive Momentum Stocks (to be considered):

ABIX, GENZ, ARX

Negative Momentum Stocks:

TOL, NTES, BOOM

BOOM is not longer booming. It was down around $3 by mid-day. It was up more than $1 this morning pre-market. Then it decided to change its trend. This is very negative for the stock. It ran up too fast too soon. Wait until the dust settles, then we can come back and look at it again later.

AQNT is very similar to BOOM in trading pattern. Even thought it beat estimate by 3 cents. It was not good enough because of the big run from the beginning of the year from $7 to $21 right now. It has too much good expectation built into the stock.

All stocks are self correcting right now. This is a good thing because we do need some kind of self-correct mechanism for the market in order to march higher.

ISRG was down this morning, it went back up by mid-day. It still has very strong momentum to the upside. I still maintain my position as it will hit $100 by Thanksgiving. If it announces split, it will go up even further up.

Today's Movers:

Positive Momentum Stocks (to be considered):

ABIX, GENZ, ARX

Negative Momentum Stocks:

TOL, NTES, BOOM

Tuesday's Pre-Market

The market is poised to open mix today after a few straight days of strong up days. There is no major announcement from the US governemtn today. The only casulty is NTES. It disappointed many investors and traders. It is a sell without a doubt.

BOOM is indeed booming today. AQNT seems to be no upside to it today.

Today's Market Movers:

Positive Momemtum Stocks:

MVCO, BOOM, NTMD, HAIN, GIVN

Negative Momemtum Stocks:

NTES

BOOM is indeed booming today. AQNT seems to be no upside to it today.

Today's Market Movers:

Positive Momemtum Stocks:

MVCO, BOOM, NTMD, HAIN, GIVN

Negative Momemtum Stocks:

NTES

Monday, November 07, 2005

Monday's After-Market

Another up day for the market today. It has been a string of many up days since last week. I do believe the market is going higher. However the volume has been lacking. Indications are good for the upside. The market is still in the process of digesting its recent gains.

I am 95% invested right now. If we break the new high with volume, I will load up my margins. The uptrend is still intact unless "something" changes it. I will keep you all updated. Look for big movers from BOOM and AQNT tomorrow morning.

After Market Movers (Not much action except NTES):

Positive Momentum Movers:

GIVN

Negative Momentum Movers:

NTES (get out of this one unless you want to short it, look for more down side for this one in the coming days), RTEC, DTSI

I am 95% invested right now. If we break the new high with volume, I will load up my margins. The uptrend is still intact unless "something" changes it. I will keep you all updated. Look for big movers from BOOM and AQNT tomorrow morning.

After Market Movers (Not much action except NTES):

Positive Momentum Movers:

GIVN

Negative Momentum Movers:

NTES (get out of this one unless you want to short it, look for more down side for this one in the coming days), RTEC, DTSI

Monday's Mid-Day

This morning I had problem connecting to the internet due to my broadband connection with my ISP. By the time I was able to connect, the market has already opened for trade. So it did not make any sense for me to post anything that was useless.

Enough about the connection, by mid-day trading today, the market is trading a in narrow range and waiting for "something" to push it higher in the days to come. The market had very strong momentum for the past week, it is in the process of digesting its gain.

One stock to be watched for this afternoon and tomorrow morning is AQNT. It is in the advertising space as Google, we all know what well Google has performed recently. I expect this one to beat all estimates, and open higher tomorrow with at least $1.

This morning, MFLX did gap up $3 this morning, and continues itself strong momentum as the day passes. I placed some buy positions in it this morning and last Friday. They were well worth the risk after the fact. There are more positive momentum stocks than negative, another good sign for the market to the upside.

Today's Movers:

Positive Momentum Stocks (to be considered):

VPHM, MFLX, IRIS, CONN, QDEL

Negative Momentum Stocks (to be avoided):

FARO (continues its downward movement from Friday), RYAAY

Enough about the connection, by mid-day trading today, the market is trading a in narrow range and waiting for "something" to push it higher in the days to come. The market had very strong momentum for the past week, it is in the process of digesting its gain.

One stock to be watched for this afternoon and tomorrow morning is AQNT. It is in the advertising space as Google, we all know what well Google has performed recently. I expect this one to beat all estimates, and open higher tomorrow with at least $1.

This morning, MFLX did gap up $3 this morning, and continues itself strong momentum as the day passes. I placed some buy positions in it this morning and last Friday. They were well worth the risk after the fact. There are more positive momentum stocks than negative, another good sign for the market to the upside.

Today's Movers:

Positive Momentum Stocks (to be considered):

VPHM, MFLX, IRIS, CONN, QDEL

Negative Momentum Stocks (to be avoided):

FARO (continues its downward movement from Friday), RYAAY

Saturday, November 05, 2005

Stock Market Weekend Review - What's Ahead for Next Week

Another great week for the market. I expect another good run for the market to break new higher by Thanksgiving holiday. The sentiment is very good lately even with all the bad news, such as Katrina, Iraq, high gasoline price, etc.

There are many break out stocks to be considered: ISRG, MRGE, LOJN. All these stocks broke out of their trading ranges, and they marched into new highs. If you have read my previous blogs, then you should have noticed them, and perhaps you have taken into some positions into them. If the market continues its uptrend. I would expect these high momentum stocks to continue their trends and breaking more new highs.

There are many break out stocks to be considered: ISRG, MRGE, LOJN. All these stocks broke out of their trading ranges, and they marched into new highs. If you have read my previous blogs, then you should have noticed them, and perhaps you have taken into some positions into them. If the market continues its uptrend. I would expect these high momentum stocks to continue their trends and breaking more new highs.

Friday, November 04, 2005

Friday's After-Market

Another up day for the market today. It was trading in a narrow range all day along, but it decided to close higher at the end of the day. All my reports will talk about what is ahead instead of action has already happened. For example, I will talk about after market mover after the market is closed, instead of the movers for the day which is already over.

Look for earning report from MFLX Monday morning. This is a fast mover. It can swing wildly on either side, +/- 5 points easily. This is a perfect stock for option trading, with call and put for out-of-money option because of the cheaper price. If history repeats, it looks like we may have a swing up day Monday morning on this one. Motorola is one of MFLX's biggest customer. From the earning report of Motorola, it looks very bullish.

After Market Movers - not too much action after market because of Friday, most of the companies do not report earning or have major news during Friday after market.

Look for earning report from MFLX Monday morning. This is a fast mover. It can swing wildly on either side, +/- 5 points easily. This is a perfect stock for option trading, with call and put for out-of-money option because of the cheaper price. If history repeats, it looks like we may have a swing up day Monday morning on this one. Motorola is one of MFLX's biggest customer. From the earning report of Motorola, it looks very bullish.

After Market Movers - not too much action after market because of Friday, most of the companies do not report earning or have major news during Friday after market.

Friday's Mid-Day Report

The market is looking to be a bit tired after a few strings of up days. I expected the market will trade sideways for the next few days until we can break the trading range. Although the indexes are in very narrow range, with Nasdaq slightly up around 1:30 pm, but there are more stocks down than up. About 16 down vs. 12 up for Nasdaq, and 19 down vs. 12 down on NYSE.

LOJN is still looking very good today. Initially I was a bit upset when I traded my position from NWRE to LOJN. But it turned out to be good today. I expect more upside for LOJN in the days to come.

Today's Market Movers:

Positive Momemtum Stocks (with increasing volumes):

LOJN, VRTY, EXPE, ESLR, VAS

Negative Momemtum Stocks (with increasig volumes):

XWG, FARO, SGMS, MGLN

LOJN is still looking very good today. Initially I was a bit upset when I traded my position from NWRE to LOJN. But it turned out to be good today. I expect more upside for LOJN in the days to come.

Today's Market Movers:

Positive Momemtum Stocks (with increasing volumes):

LOJN, VRTY, EXPE, ESLR, VAS

Negative Momemtum Stocks (with increasig volumes):

XWG, FARO, SGMS, MGLN

Friday's Pre-Market

The market is poised to open mix today after a few straight days of strong up days. The US unemployment rate is lower than expected. The market will to digest the gain from the past few days. Look for consolidation through out the day.

Today's Market Movers:

Positive Momemtum Stocks:

ESLR, AMPX, EXPE, ADBL

Negative Momemtum Stocks:

ZIPR, FARO, MGLN

Today's Market Movers:

Positive Momemtum Stocks:

ESLR, AMPX, EXPE, ADBL

Negative Momemtum Stocks:

ZIPR, FARO, MGLN

Thursday, November 03, 2005

Thursday's After-Market

Another strong finish for the market today. It was the third strainght up day. One thing I have noticed is that many stocks opened strong, but finish lower or with a small gain. Some examples of these stocks are: AOES, ELOS, SHLD. Perhaps the market is a bit tired, or perhaps we went up too fast to soon. I expect correction maybe coming in the next few days. Or is it will slow down a little bit. I would use some caution here. Until we break the trading range, it could still see the big swing up and down days again.

After Market Movers (not too much action after market):

Positive Momentum Stocks:

EXPE, ADBL

Negative Momentum Stocks:

XWG, ZIPR

After Market Movers (not too much action after market):

Positive Momentum Stocks:

EXPE, ADBL

Negative Momentum Stocks:

XWG, ZIPR

Thursday's Mid-Market Updates

The market is looking to be closed higher today. Great news about the US goverment's report out this morning was fuel to the bull. More up volumes than down volumes.

LOJN gapped up this morning, I was able to get some this morning. The up momentum for this stock is unbelieveable. The volume is 2000% times the normal trading volume. It looks very bullish. NWRE came down a bit today, I am looking for more consolidation for this one in the coming days. I sold all position on this one, all money from NWRE went into LOJN. ISRG still looking very strong today, another new high.

Today's Market Movers:

Positive Momemtum Stocks:

CKCM, PCLN, ELOS, LOJN, ABGX, CRYP

Negative Momemtum Stocks:

PEET, IMCL, SFCC, LSCP, MVSN, SYMC(another down day)

LOJN gapped up this morning, I was able to get some this morning. The up momentum for this stock is unbelieveable. The volume is 2000% times the normal trading volume. It looks very bullish. NWRE came down a bit today, I am looking for more consolidation for this one in the coming days. I sold all position on this one, all money from NWRE went into LOJN. ISRG still looking very strong today, another new high.

Today's Market Movers:

Positive Momemtum Stocks:

CKCM, PCLN, ELOS, LOJN, ABGX, CRYP

Negative Momemtum Stocks:

PEET, IMCL, SFCC, LSCP, MVSN, SYMC(another down day)

Wednesday, November 02, 2005

Thursday's Pre-Market

The market is poised to open higher today from the strong up momentum from yesterday's dramatic bull rush. Also the US workers productivity number announced this morning was much better than expected, and the unit labor cost was down last month, better than expected. All in all, the news are added the bull fire. Look for the market to march to new high in a few weeks, definitely before the year ends.

The market up momentum is intact. Leaders like ISRG will continue to roar. $100 is near. More upside movers than down movers before the open. I am loading up more positions today. It is time for margin if you can bear risk.

Today's Market Movers:

Positive Momemtum Stocks:

GPRO, PCLN, ELOS (wow, great numbers!), LOJN, QCOM, ABGX, AMGN,

Negative Momemtum Stocks:

PEET, IMCL, LSCP, OVEN, NEOG

The market up momentum is intact. Leaders like ISRG will continue to roar. $100 is near. More upside movers than down movers before the open. I am loading up more positions today. It is time for margin if you can bear risk.

Today's Market Movers:

Positive Momemtum Stocks:

GPRO, PCLN, ELOS (wow, great numbers!), LOJN, QCOM, ABGX, AMGN,

Negative Momemtum Stocks:

PEET, IMCL, LSCP, OVEN, NEOG

Wednesday's After Market

Wow! What a punch by the bull today! It was a very strong up volume day. It is no doubt, another accumulation day. It is time to load up stocks now. Stocks with strong up momentum will tend to be up in the up market like today.

ISRG is a good example of leadership. It broke thru the old high which was created a week ago when it reported strong earning. It is still in the uptrend. I predict it will hit $100 in matter of days. On the other hand, if you pick the traditional former leader stocks like Microsoft (MSFT), it does not budge when the market moves. NWRE is another leader, but after the market closed, it reported earning. It does not blow the estimate away as expected, so I expected it may go down a bit before another leg up, it will be a sell or hold on this one.

After Market Movers:

Positive Momentum Stocks:

GPRO, AEOS, GES, PCLN

Negative Momentum Stocks:

CECO, OVEN, HOTT

ISRG is a good example of leadership. It broke thru the old high which was created a week ago when it reported strong earning. It is still in the uptrend. I predict it will hit $100 in matter of days. On the other hand, if you pick the traditional former leader stocks like Microsoft (MSFT), it does not budge when the market moves. NWRE is another leader, but after the market closed, it reported earning. It does not blow the estimate away as expected, so I expected it may go down a bit before another leg up, it will be a sell or hold on this one.

After Market Movers:

Positive Momentum Stocks:

GPRO, AEOS, GES, PCLN

Negative Momentum Stocks:

CECO, OVEN, HOTT

Wednesday's Mid-Day Updates

The market is marching higher today after the FED meeting is behind us for now. Look for another accumulation day today. I am loading up the my boat today. Everything looks very bullish from this point on. We should have a very decent up days during the holidays.

The following stocks will report earnings tonight, NWRE (my beloved stock), RMD (risky buy). My previous picks: CSTR (down slightly, I will sell it if go down further), MRGE (still looks good,came back from new high)

Market Movers today:

Positive Momentum Stocks:

CUTR, HANS, ISRG (my stock), BBOX, IPMT

Negative Momentum Stocks:

SYMC, MCAF, MERQE, WMS, SFCC

The following stocks will report earnings tonight, NWRE (my beloved stock), RMD (risky buy). My previous picks: CSTR (down slightly, I will sell it if go down further), MRGE (still looks good,came back from new high)

Market Movers today:

Positive Momentum Stocks:

CUTR, HANS, ISRG (my stock), BBOX, IPMT

Negative Momentum Stocks:

SYMC, MCAF, MERQE, WMS, SFCC

Wednesday's Pre-Market

Looks like the market will open lower today wiith the continuation of the negative momentum yesterday. According to the street prediction, FED has a very good chance of raising another 50 points from today, two more rate increasing in the coming months.

Until the FED is done with raisng rate, the market maybe still in the trading range. A few known company reported earnings after close yesterday and this morning. SYMC seems to be heading lower because of it, this is the one to avoid now. PNRA beats but not too convincing, I would avoid this one for now too. Until the market moves out of the negative territory today, I would not place any buy today.

Today's Movers:

Positive Momentum Stocks:

ZVXI (very speculative one, avoid), IVIL, IPMT, CUTR

Negative Momentum Stocks:

MERQE (avoid the E at the end), SYMC, JUPM, INTX, VCLK

Until the FED is done with raisng rate, the market maybe still in the trading range. A few known company reported earnings after close yesterday and this morning. SYMC seems to be heading lower because of it, this is the one to avoid now. PNRA beats but not too convincing, I would avoid this one for now too. Until the market moves out of the negative territory today, I would not place any buy today.

Today's Movers:

Positive Momentum Stocks:

ZVXI (very speculative one, avoid), IVIL, IPMT, CUTR

Negative Momentum Stocks:

MERQE (avoid the E at the end), SYMC, JUPM, INTX, VCLK

Tuesday, November 01, 2005

Tuesday's After Market

The market closed lower today. It was a distribution day for techicians. The up/down volume is about 12 ups for 17 downs. The down market is contributed by the Dell profit and revenue warnings. From the surface, the market does not look that bad at all. There is no market panic sell-off. The market is still trading in a narrow range between 2050 to 2150. The market is waiting for the FED to stop raising the rate soon. I believe if the FED stops, market will break the trading range.

The leaders for the days are still very strong, GOOG is no doubt the leader for the big caps. NWRE is another one to be emerged as another leading performer for the small caps. The semi does not look good at this point because of DELL and INTC.

After market stocks movers:

Positive momentum stocks:

CUTR (look for an entry buy), TRDO

Negative momentum stocks:

SYMC, JUPM

The leaders for the days are still very strong, GOOG is no doubt the leader for the big caps. NWRE is another one to be emerged as another leading performer for the small caps. The semi does not look good at this point because of DELL and INTC.

After market stocks movers:

Positive momentum stocks:

CUTR (look for an entry buy), TRDO

Negative momentum stocks:

SYMC, JUPM

Tuesday's Mid-Day

The market trades in a very narrow range by noon today. Dell has dampered the market because of the profit and revenue warning, but it did not have any major impact like what it used to have. Overall, it is not major event. Google will have a much bigger impact on market than Dell these days. No doubt the leadership has changed from the old to new (Dell to Google). The movement of Google signify this change. Aside from leadership impact, the FED meeting is the center piece for the afternoon.

Today NWRE is another leader in the making. It is making another new high today. Earning is coming out on November 3, I am expecting it will beat the target when it announces on that day. As I have previously discussed, it is in a strong uptrend.

Today's market positive momentum movers:

GOOG, AMED, APPX(from down to up), RVSN (got small position this morning), IVAC

Today's negative momentum movers:

AACC, DELL, TTWO

Today NWRE is another leader in the making. It is making another new high today. Earning is coming out on November 3, I am expecting it will beat the target when it announces on that day. As I have previously discussed, it is in a strong uptrend.

Today's market positive momentum movers:

GOOG, AMED, APPX(from down to up), RVSN (got small position this morning), IVAC

Today's negative momentum movers:

AACC, DELL, TTWO

Tuesday's Pre-Market

The market is poised to open lower today because of Dell's profit warning. I personally think Dell is a non event for the market. The main concern probably the FED meeting this afternoon announcement. Look for the market to swing back at the end of the day if the FED is doing what the market expected.

Today's positive momentum stocks are:

IVAC, RVSN, ESLR (Cramer's pick)

Today's negative momentum stocks are (stocks to avoid for longs):

NABI (outch!), AACC, PUMP, TTWO, DELL

Today's positive momentum stocks are:

IVAC, RVSN, ESLR (Cramer's pick)

Today's negative momentum stocks are (stocks to avoid for longs):

NABI (outch!), AACC, PUMP, TTWO, DELL

Subscribe to:

Comments (Atom)